Calculator

What is enfranchisement?

Welcome to our information site. The site is hosted by award winning LBB Chartered Surveyors and is an information site for our current and future clients aimed at helping you with buying your freehold.

Our calculator is designed to assist you. It does not give formal valuation advice but it will give you an indication of what the purchase price may be.

We look forward to helping you, so please feel free to contact us on info@leaseholdenfranchisement.co.uk.

What is enfranchisement and collective enfranchisement?

The Leasehold Reform Act 1967 (as amended) allows a leaseholder of a house to enfranchise (buy) their freehold.

The Leasehold Reform Housing and Urban Development Act 1993 (as amended) allows leaseholders of blocks of flats to collectively enfranchise (buy) their freehold.

Qualification

Registered ownership is required for enfranchisement, but the amount of time your interest is registered this varies between houses and flats.

Houses

The right to enfranchise is dependent upon a number of qualifications for the house. The house must be a building reasonably considered a house, divided vertically from any adjoining house. It does not matter if it has been divided into flats so long as you have the lease of the whole house.

The lease must be a long lease, originally for a term of more than 21 years or with a right to renewal. There are also certain restrictions in respect of leases for original terms of less than 35 years, (i.e. business leases).

The leaseholder must have been the registered owner for a minimum of 2 years.

Flats

The property itself must be a self-contained building or part of building. There must be 2 or more qualifying tenants. The total number of flats held by such tenants must not be less than 2/3rds of the total number of flats contained in the premises. If an owner is the leaseholder of more than two flats, those flats are no longer qualifying tenants. 50% of leaseholders must participate.

Unlike houses, the leaseholders only need to be registered owners.

Our calculator

Our calculator is simplified to provide you with an indication of the individual cost of enfranchisement, for most house and individual flat owners.

It does not deal with the situation where there are “low value” houses where marriage value is not applicable and blocks of flats, where there are multiple leaseholders or where there is a mixed-use building.

Our expert valuer can assist you in these situations.

About LBB Chartered Surveyors

LBB Chartered Surveyors is a highly regarded, award winning and well-established firm, having been in practice since 1994. We work throughout the UK, however, being situated near Fleet Street, we are ideally positioned to serve Central London and the South East.

Enfranchisement - LBB Chartered Surveyors Call us on 0207 822 8850

With a unique mix of Building Surveying and Valuation expertise we are capable of dealing with a wide variety of residential and commercial property issues.

Background - 1967 Act - Houses

Summary of the legislation

The Act provides two distinct bases for valuation of houses under the Act, dependent upon the section of the Act under which the house qualifies.

The appropriate method of valuation requires expert input.

Section 9 (1)

Where the house qualifies under Section 1 it will be valued according to the original valuation basis. This valuation is with reference to the site value of the house.

Section 9 (1A), 9(1AA), 9(1C)

The special valuation basis is prepared with reference to the value of the house, including a share of the marriage value.

This calculator sets out a broad valuation under the latter.

Valuation under the special valuation basis includes:

i) Calculating the term - This is the valuation of the rent the landlord receives throughout the lease term.

ii) Calculating the reversion - On expiry of the lease the freeholder will receive the house with vacant possession and will be able to realise its full value. It is therefore necessary to estimate its freehold vacant possession value, deferred until the end of the existing lease.

iii) Calculating the marriage value - Marriage value sets from the increase in the value of the property following the completion of the enfranchisement. It is the profit released from merging the interests. The legislation requires that it be shared equally between the parties. Marriage value is not payable where lease terms are 80 years or more.

iv) Completing the valuation - The purchase price for the freehold is the sum of the values of the freeholder's interest and their share of the marriage value. There may be an additional sum, when the freeholder suffers loss to other property as a result of the enfranchisement or where there is development value.

Background – 1993 Act – Flats and Collective Enfranchisement

The Leasehold Reform Housing and Urban Development Act 1993 (as amended) gives leaseholders the right to enfranchise their freehold, subject to certain qualification requirements. One of the amendments made by the Commonhold and Leasehold Reform Act 2002 was that if leases have an unexpired term of more than 80 years any marriage value is ignored: This is not to say that it does not exist where the lease term has greater than 80 years remaining. The cut-off date is the valuation date. The valuation date is normally assumed as the date of the notice, but technically it is the date of receipt of the tenants’ Section 13 Notice.

The basis of valuation is subject to the following statutory formula, which is the sum of the following:

- The value of the landlord’s interest in the building,

- The landlord’s share of any marriage value,

- Any other amount of compensation payable, such as development value.

- Apportionment is needed between the Specified Premises (building) and Appurtenant Land (generally considered as the gardens or any garages etc).

What is the value of the landlord’s interest?

Prior to an enfranchisement, the landlord will probably have a ground rent income throughout the lease term. The landlord will also receive the property back at the end of that lease.

As such, their interest is made up of the sum of:

- The capitalised value of the rental income payable under the existing lease;

- Plus, the present value to the landlord of receiving the flat at the end of the existing lease.

This loss is normally all that is paid for the freehold if your current lease has more than 80 years remaining.

If there is less than 80 years remaining, then marriage value will be payable. The landlord will receive 50% of this marriage value.

What is marriage value?

Marriage value is specifically defined in the legislation but essentially it is the profit released from marrying the interests of the parties after and comparing it to the amount of the interest before. On occasions it may be small but as the length of your lease reduces the difference increases. It is basically:

- The value of the freehold interest

Compared with

- the aggregate of:

-

- the value of the interest of the tenant under his existing lease; and

- the interest of the landlord(s) prior to the grant of the new lease

Where marriage value is applicable, the tenant is required to compensate the landlord for half (50%) of the marriage value (or profit derived from the lease extension).

How is marriage value calculated?

A longer lease of a property will be more valuable than a shorter lease of a property. On this basis, the freehold would represent the most valuable asset. If the freehold represents 100% of value, valuer will often refer to the relative value of the lease – or relativity.

What is Relativity?

Relativity is an expression used to measure the difference in price between a leasehold value and that of an effective freehold. It is often expressed as a percentage.

Historically this was established by negotiation, “graphs”, tribunal, or other determinations.

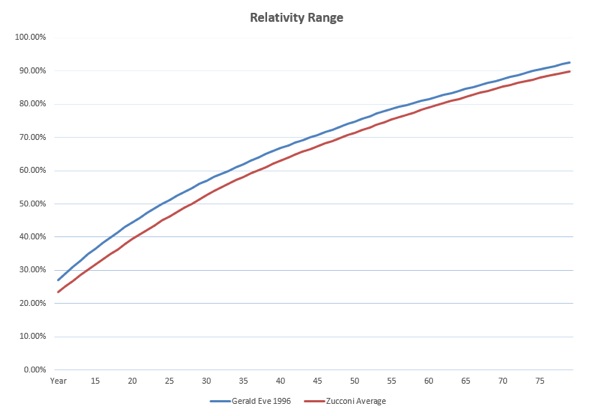

Graphs of Relativity are still used, but the tribunals will prefer market evidence of sales of short leases. The graph below is the graph used in the calculations on this website.

It shows the how the value of a lease reduces as the lease term reduces. It is not a definitive graph but illustrative in allowing us to help you.

Your results explained

For assistance please email us on info@leaseholdenfranchisement.co.uk

There are numerous variables in the valuation that develops the price range.

Each variable will have a margin for negotiation. This is why it is necessary to obtain proper professional advice before embarking on an enfrachisement.

The main variables are:

- Capitalisation rate;

- Deferment rate;

- Lease length / Relativity;

- The "no Act world";

- Tenant's improvements;

- Value of appurtenant land (gardens, garages, etc); and

- Any development potential

Capitalisation rate

This rate is used to calculate the Years Purchase multiplier to generate the present-day value of the ground rent income through the lease. The rate will vary depending on the level of rent, the frequency of review and the amount of any increase.

The calculator does not account for reviews but we can assist you with this calculation.

Deferment (or discount) rate

Prior to Sportelli this varied throughout the country and throughout central London. This case introduced the concept of a generic (nationwide and property-wide) rate of 5%.

Potentially if your property has specific issues or it is outside of London, it may be possible to adjust this rate. The calculator only works off 5%: The higher rate, the lower the premium.

Our expert surveyors can assist you with determining the appropriate rate. This may change if the lease flats below 20 years.

Lease length / Relativity;

As noted earlier, the calculator makes assumptions based on graphs. Our expert surveyors will also consider sales in the marketplace when valuing your property. This may be advantageous to you.

The value of the short lease and the "No-Act" world assumption.

The 1967 and 1993 Act requires an assumption says that you have no right to buy the freehold. This is often termed the "no Act world" assumption.

In the market you can extend your lease or buy your freehold because of the 1967 Act. Therefore, it is necessary to consider how much of a discount there needs to be to reflect this right.

The longer the lease the less this discount might be. For illustration, this may be:

By 2.5%-5% for a 60-80 year plus lease;

By 5-10% for a lease between 45 and 60 years;

By 10-15% for say 30 to 45 years lease; and

By 15-35% for shorter leases.

Tenant's Improvements

The Act allows for tenant’s improvements to be disregarded. If there are works, such as altering the layout or adding en suite bathrooms, then maybe it is necessary to reduce the value of the property.

If you have undertaken works of improvement, it will be essential to have a formal valuation of your property. Again, our valuers will be able to help you.